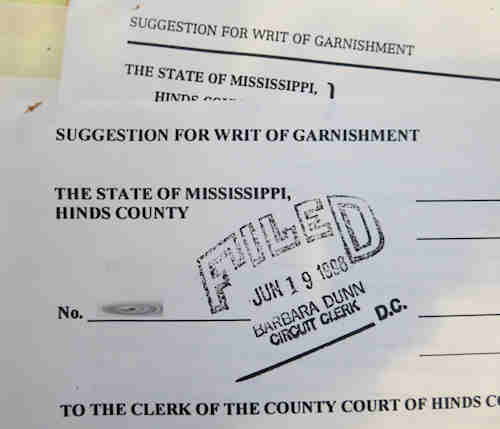

What is garnishment?

Garnishment is a legal process that requires a third party who is holding your property to turn it over. That third party may be your employer. It may be your bank. The type of property most commonly garnished is wages (wage garnishment). Money in a bank account is another type of property that is commonly garnished.

How does wage garnishment work in Mississippi?

In Mississippi wages that are earned within the first 30 days after the writ of garnishment is served on the employer are protected and must be paid over to the employee. Once the thirty days are up, wage garnishments are then limited only by the Federal Wage Garnishment Law.

Under the Federal Wage Garnishment Law of the Consumer Credit Protection Act the most that may be taken in a typical garnishment is 25% of your disposable earnings (this amount is different for IRS debts, alimony, child support and student loans – see below).

Your disposable earnings are what are left after your employer makes the legally required deductions for federal and state taxes, your share of state unemployment insurance and social security.

Can a credit card garnish wages?

Yes, but they must go to court before garnishing wages. Under most circumstances in Mississippi, creditors can only garnish your wages or bank accounts after they have a judgment or other court decree against you. A judgment is the final decision of a court entered by a court at the end of a lawsuit.

How can I stop a wage garnishment from a credit card?

In most circumstances, bankruptcy is a way to permanently stop the garnishment. For a garnishment that is related to an unsecured debt such as a credit card, the debt will be wiped out in bankruptcy and you will not have to worry about being garnished because of that particular debt again.

Alimony and child support garnishments limits are higher

Under the federal act, a garnishment for child support or alimony can be in an amount of up to 50% of disposable income if the employee is supporting another spouse or child. If the employee is not supporting another spouse or child the garnishment can be as high as 60%. If the garnishment is for support payments that are over 12 weeks behind an additional 5% can be tacked on to these numbers.

Student loan garnishments are at a different rate

Generally speaking, student loans are considered a non-tax debt owed to a federal agency. Wage garnishments based of these loans is limited to 15% of your disposable earnings. The government does not have to get a court judgment to begin garnishing your wages for federal student loans.

IRS wage garnishments follow a different set of rules

The IRS is not limited by the Federal Wage Garnishment Act. Instead, the IRS is only required to leave you an amount of income necessary for you to pay for your basic living expenses. These amounts are figured using IRS tables that take into consideration your income and the number of dependents you have. The IRS does not have to get a court judgment to begin garnishing your wages for federal income taxes.

How can I stop a wage garnishment?

Although there are exceptions, bankruptcy stops most garnishments. Bankruptcy can be used to stop this process at almost any stage during the garnishment process, even after a garnishment has started.

Bankruptcy will not stop garnishments for certain types of debt

Domestic support obligations

Domestic support obligations such as child support and alimony are not wiped out by bankruptcy. Wages earned after the filing of a Chapter 7 bankruptcy are subject to collection actions for a domestic support obligation.

Chapter 13 bankruptcy provides a way to stop this type of garnishment. These obligations are still being paid off through the Chapter 13 bankruptcy, but in an orderly way that is done under the terms of the court approved payment plan you submit.

Federal income tax debts

Garnishment related to tax debts will typically be stopped during a bankruptcy, but tax debts that do not meet certain criteria will not be discharged in bankruptcy.

After the completion of a Chapter 7 bankruptcy, the IRS and Mississippi Department of Revenue can restart their collection efforts. A chapter 7 case will typically be over in about four months. Depending on your circumstances, a Chapter 7 may wipe out enough debt to allow you to pay off the tax debts after the bankruptcy is over.

A Chapter 13 bankruptcy is another way to deal with tax debts by paying them through the Chapter 13 plan over time. While the Chapter 13 is in place, the tax authorities generally will not be able to garnish wages or other assets.

Garnishment of bank accounts or other property

As mentioned above, garnishment is not limited to paychecks. Garnishment can apply to other property you own, including, but not limited to, bank accounts. It is common to see the garnishment of bank accounts in Mississippi. This type of garnishment can be especially problematic with bank accounts that are held in the name of more than one person (joint accounts). This can cause a lot of problems, both financially and personally. If you are facing any of these issues an attorney can help you determine what your options are.

If you are dealing with a situation where your paycheck and other assets are about to be garnished, or are already being garnished we can help you figure out what your options are. To schedule an initial free and confidential consultation to discuss your particular situation call 601-853-9966.