Debt Collection Lawsuits in Mississippi

If you are behind on your bills, at some point you might get sued. Debt collection lawsuits are commonly filed by credit card companies, medical providers, furniture stores and other creditors. Here is what you can likely expect if you are being sued for a debt such as a medical debt or a credit card debt in a Mississippi court.

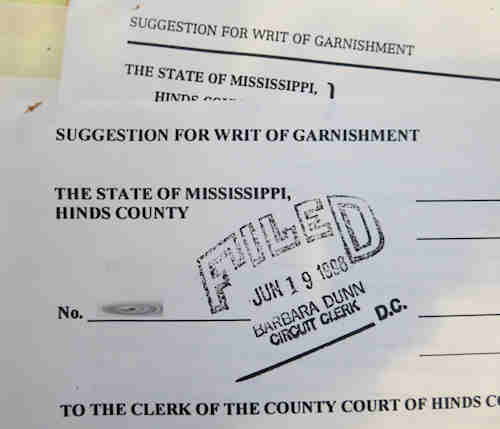

A Suggestion for Writ of Garnishment filed in Jackson, Hinds County, Mississippi

The Complaint in a debt collection lawsuit

The Complaint is the document filed with the court that starts the debt collection lawsuit. The complaint is the document that states the details of who is suing you, why the creditor is suing you and the amount they are claiming. The creditor will typically have 120 days from the filing of the complaint to deliver a copy to you with a summons.

Have you received a summons from a debt collector?

Individuals often first learn of a lawsuit when they get a court summons for a debt collection lawsuit. The summons is a document that announces that the court proceeding has been started and lets the person served with it know how long they have before they have to respond to the complaint. Typically a summons will be issued by the court at the same time the complaint is filed and is delivered to you with a copy of the complaint.

Court summons for a debt

If you have received a court summons for a debt collection lawsuit you need to act quickly. In a lawsuit filed in Mississippi you will typically have a short amount of time before the response, called the Answer, is due. If you do not respond, you will likely waive any defenses you may have and a default judgment can be entered against you. Even if you feel that you owe the creditor money, there might be a dispute as to the total amount they are claiming, including the interest rate and penalties. You might also be able to defend based on the age of the debt. In other words, the creditor may not have filed the lawsuit within the time allowed by law, the statute of limitations. A lawyer can help you determine whether these and other defenses may apply to your case.

Response to the summons and complaint for a debt

Your response to the Complaint is where you respond to the claims made against you and raise any defenses you have to the lawsuit. If an Answer is not filed, defenses you may have will likely be waived. A lawyer can help you decide how to respond to the summons and complaint.

Default Judgment in a debt collection lawsuit

If a response to the lawsuit is not filed, the party bringing the lawsuit can ask the court to enter what is called a default judgment. A default judgment is essentially the Court’s act of entering a binding ruling against someone because they failed to respond to the lawsuit filed against them.

Once a default judgment has been entered, a creditor can then use it to seek to garnish your wages and other property. In Mississippi, a default judgment acts as a lien against property you have in any county where the judgment has been properly entered.

What can you do if a default judgment has been entered against you in a debt collection suit?

You may be able to get the judgment set aside if you can prove that you weren’t properly notified about the lawsuit and that you want to fight it. To do this, you must formally ask the Court to set aside the default and let you go forward with the defense of the lawsuit.

If setting aside the judgment is not a good option you might try to settle the amount of the judgment with creditor.

If you don’t have any good defenses to the lawsuit and are not in a position to settle the debt, bankruptcy may provide a good option to keep your wages and property from being garnished.

What should you do if you have been sued for a debt?

If you live in central Mississippi and are interested in learning how bankruptcy can put a stop to lawsuits and other collection actions, please call me for a free and confidential consultation. My phone number is 601-853-9966.